06 Oct Crowd Marches to Chevron Refinery in Support of Prop. 15

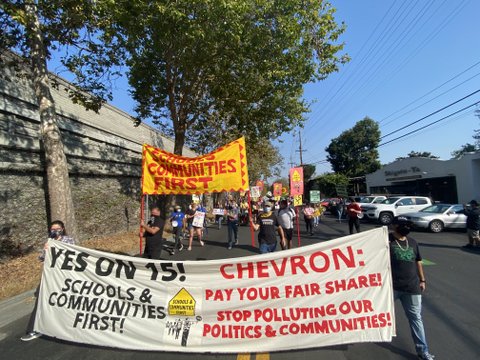

Supporters of Proposition 15 say holding companies such as Chevron to up-to-date property tax rates would bring needed funding to schools, streets and more. (Denis Perez-Bravo / The CC Pulse)

By Joel Umanzor Jr.

An estimated 80 people marched from George Carroll Park to the gates of the Chevron refinery Sept. 30 in support of Proposition 15.

Among the coalition who attended the event were the Alliance of Californians for Community Empowerment Action, the International Professional and Technical Engineers Local 21, United Teachers of Richmond and other unions representing various West County educators.

According to the California State Voter Guide, Prop. 15, also known as the Schools and Communities First Initiative, would increase taxes on commercial and industrial property based on the current market value of the land instead of the original purchasing price. Last year, a state fiscal analyst estimated that passing the ballot initiative would generate between approximately $8 billion and $12.5 billion in state revenue per year.

James Sanderson of ACCE said it’s past time to reexamine this corporate tax break, established in 1978 with the passage of Proposition 13, which allows large businesses such as Chevron to continue to pay 1970s level taxes.

Demonstrators picketed outside the refinery, calling for voters to close that loophole in November.

“Chevron hasn’t paid their taxes like they should since 1978. It’s 2020,” Sanderson said. “If they paid $20 million in taxes a year, the highways and streets would be repaired. The schools would be better because you would get a better education. We would have money to build a hospital in Richmond. So we need to find a way to get everyone who is voting to vote for Prop. 15.”

“Chevron hasn’t paid their taxes like they should since 1978,” said one Prop. 15 supporter who was part of a protest march to the Chevron refinery on Sept. 30. (Denis Perez-Bravo / The CC Pulse)

In the 2019-20 fiscal year, Chevron paid nearly $49 million in property taxes to Contra Costa County. That figure makes Chevron the top taxpayer in the county but accounts for less than 2% of the county’s total property tax revenue.

Opponents of Prop. 15 argue that a large property tax increase would likely be passed onto consumers in the form of higher prices. They also say the measure would be expensive to administer and would hurt small businesses already struggling during the pandemic.

The demonstration ended at the front gates of the refinery on Castro Street where various community members spoke about the need for Chevron to contribute to the community.

Proponents of the amendment, such as 30-year-old educator and school board candidate Demetrio Gonzalez-Hoy of Richmond, agree that the bill would be crucial for much needed funding of California’s public schools.

“There are so many reasons why we need this funding,” said Gonzalez-Hoy, former president of United Teachers of Richmond. “This is going to bring about $18 million dollars to the West Contra Costa Unified School District. We just went through a $56 million dollar deficit for our schools and we had to cut some essential services for our kids. We had to increase class sizes. We had to cut grammar tutors who directly support newcomers and English language learners. We need this funding to bring all this back and we need more.”

Gonzalez-Hoy added that although California is the fifth largest economy in the world, it still ranks 41st in spending per person. But with the passing of Proposition 15, he says there would be an improvement in how much money is going to residents.

Francisco Ortiz, a teacher at Ford Elementary School in Richmond, reminded those in attendance of the negative impact Chevron makes on the community and reiterated Gonzalez-Hoy’s statement about the financial importance of Prop. 15 for West County schools.

“I’m also a product of this district and one thing I want to recall for anyone who is a student or a teacher here is that at 11 o’clock on Wednesday, what do we hear?” said Ortiz. “The 11 o’clock Wednesday alarm that lets us know there might be an explosion that might increase our asthma for all of our students in North Richmond and the rest of West Contra Costa. So we can no longer allow the Richmond refinery from Chevron to continue to not pay their taxes.”

Ortiz also directly correlated the passing of Prop. 13 in 1978 to the changing demographics of Californians and the reduced amount of spending on public education.

A report conducted by the Public Policy Institute of California in the late 1990s examined the “unintended consequences” of Prop. 13. One of which was a steady decline in educational spending that began in 1985, taking California from the national average educational spending to below the average.

City Council and ACCE Action member Melvin Willis, who is up for reelection, said the amount of tax money from the Richmond refinery would be a win for those who wish to see more financing for the community.

“People who become new business owners or new homeowners are forced to pay the tax rates of today and it’s just not only unfair, but it’s not enough to keep cities and counties in the state resourced for the services that are required for the public,” said Willis. “So closing this corporate loophole, there is an estimation, I keep hearing from multiple people, that $4 million dollars extra a year on property taxes if Prop. 15 would pass from this refinery alone.”

Smith-J

Posted at 06:53h, 07 OctoberAttempts at balanced reporting might include a quick public records search to discover what is actually paid to the County and City in taxes. Literally 3 minutes of browsing =

https://www.contracosta.ca.gov/DocumentCenter/View/2646/Top-Ten-Taxpayers-in-County-PDF?bidId=

https://www.ci.richmond.ca.us/DocumentCenter/View/54131/Proposed-FY2020-21-Operating-Budget

https://www.ci.richmond.ca.us/DocumentCenter/View/53558/FY-19-20-and-FY-20-21-Budget-Updates-and-5-Year-Forecast–May-26-2020